U.S. states Nevada, Wyoming and Delaware are facing growing pressure to address their lack of corporate transparency, as the United States and the international community continue to respond to fallout from the Panama Papers.

At a London anti-corruption summit on Thursday, representatives from the Cayman Islands, Bermuda and the Isle of Man warned that the “hypocrisy” of the U.S. was hurting the global push for greater financial transparency.

The summit, hosted by British Prime Minister David Cameron and attended by leaders and high-ranking officials from around the world, has drawn increased public attention after the Panama Papers investigation by ICIJ, German newspaper Süddeutsche Zeitung and more than 100 media partners revealed new details about how the world’s rich and powerful use and sometimes abuse secrecy jurisdictions and tax havens.

U.S. Secretary of State John Kerry compared the threat posed by corruption to the threat posed by terrorism, and urged attendees to work together in the fight for transparency.

“Corruption, writ large, is as much of an enemy, because it destroys nation states, as some of the extremists we are fighting or the other challenges we face,” he said.

But the U.S. came under fire from some of the smaller jurisdictions at the conference for not doing enough to combat financial opacity at home.

Cayman Islands premier Alden McLaughlin warned that if the U.S. and other larger jurisdictions didn’t comply with stricter rules being imposed on the rest of the world, then “all the shady business is going to migrate to Delaware, Wyoming, Panama, you name it.”

“It is time to put behind us the shades of hypocrisy that have been part and parcel of global discussion of this issue for years and years. So long as countries with real commitments on the world stage continue to focus on jurisdictions that are smaller in size while ignoring the larger jurisdictions, the results will be continued failure,” he said.

The U.S. states of Wyoming and Nevada both came under closer scrutiny from within the United States earlier in the week, when Sen. Ron Wyden, a Democrat from Oregon and ranking member of the Senate Finance Committee, sent a letter to the secretaries of state for the two states, demanding more information about how the companies revealed in the Panama Papers are regulated.

“I have become increasingly concerned about the use of anonymous shell companies as vehicles for terrorists financing, tax evasion, and fraud targeting major government programs,” Wyden wrote.

The senator’s letters were one of a number of responses from global authorities and governments following the publication of Panama Papers data and continued investigation from ICIJ’s partners:

- The UK, Nigeria, Kenya, France, the Netherlands and Afghanistan have agreed to set up central registers of beneficial ownership of companies that would be open to the public to search.

- UK Prime Minister David Cameron introduced a new corporate money-laundering offence aimed at forcing companies to take more responsibility for employees’ actions.

- The government of Japan will propose an action plan for combating graft at the next Group of Seven economic summit later in May.

- Wealthy international investors may start to sell off their luxury London homes after new anti-corruption rules are introduced, a leading real estate agent warned.

- Panama gave in to international pressure and joined about 100 countries in an agreement to share financial information automatically to tackle tax evasion, according to the OECD.

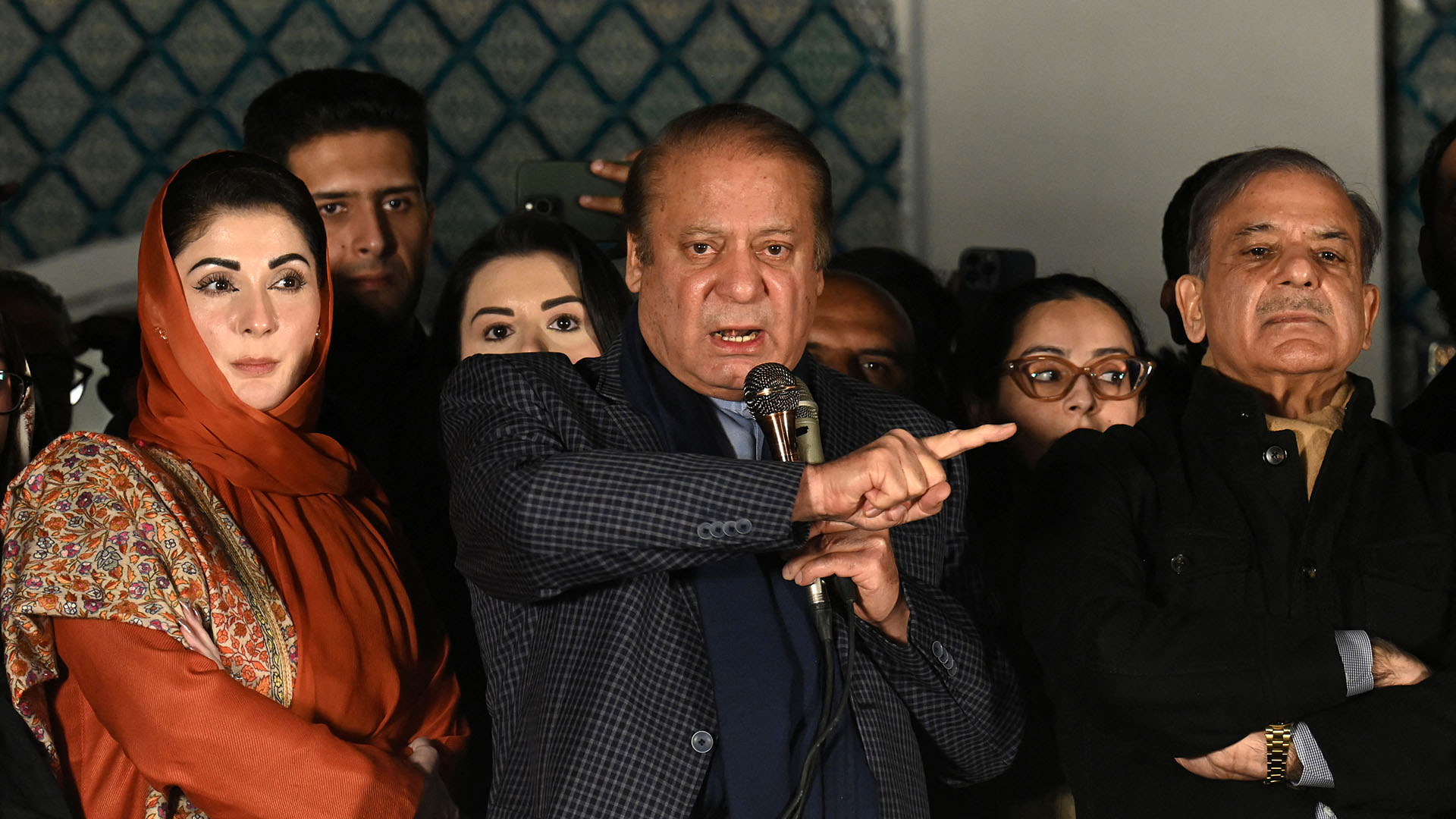

- Pakistan’s government has been asked by the country’s Supreme Court to legislate a special law to empower a commission of inquiry to look into the Panama Papers revelations.

- Mexico has widened a tax evasion probe by requiring banks to hand over names of local clients with transactions in tax havens.

- Indonesia’s tax office announced that it would launch an investigation into 272 Indonesians whose names are mentioned in the Panama Papers.

- A group of leading economists and influential advisors to policymakers signed an open letter to world leaders asserting that tax havens “serve no useful purpose” and calling for new global cooperation to increase financial transparency.

- Canadian investigators are analyzing the files and have committed to lay criminal charges should any wrongdoing be found.

- Sri Lanka has set up a panel to probe its nationals mentioned in the Panama Papers, as part of a broader bid to clean up corruption in the country.

- Vietnam’s tax authority has formed an inspection team to look into the Vietnamese names and companies revealed in the Panama Papers data, and is also renewing focus on policing transfer pricing and tax avoidance by corporations.

- Iceland president Ólafur Ragnar Grímsson announced he would withdraw from his re-election campaign, after it was revealed that his wife’s family had significant offshore holdings.

- More prominent public figures have been linked to companies mentioned in the Panama Papers, including Australia’s current prime minister, Malcolm Turnbull, Guatemalan politician Harold Caballeros, and British film star Emma Watson.